2024년 고2 6월 전국 연합 모의고사

변형 문제 Part 3

일반 워크북 형태의 문제에서 벗어나 The Makings가 만든

2024년 고2 6월 전국 연합 모의고사 변형 문제 Part 3

출판사에서 오랫동안 영어 번역과 교정을 하셨던 원어민 선생님과

현직에서 강사를 하고 있는 연구진들이 학생들을 위한 최상의

2024년 고2 6월 전국 연합 모의고사 변형 문제 Part 3을 선보입니다.

사고력과 이해력을 요구하는 문제들로 내신 대비 뿐만이 아니라

수능도 한꺼번에 공부하실 수 있는 자료입니다.

중간고사&기말고사 전에 더메이킹스(The Makings)에서 제작한

2024년 고2 6월 전국 연합 모의고사 변형 문제로 마무리 하세요.

정답 확인 하러가기!

2024년 고2 6월 전국 연합 모의고사 변형 문제 Part 3_PDF

2024년 고2 6월 전국 연합 모의고사 변형 문제, 내신대비, 영어내신자료,고등영어자료, 모의고사 변형문제,전국 연합모의고사 변형자료, 모의고사 영어 서술형 대비, 대치동 고등 영어자료, 대치

themakings.co.kr

themakings.co.kr

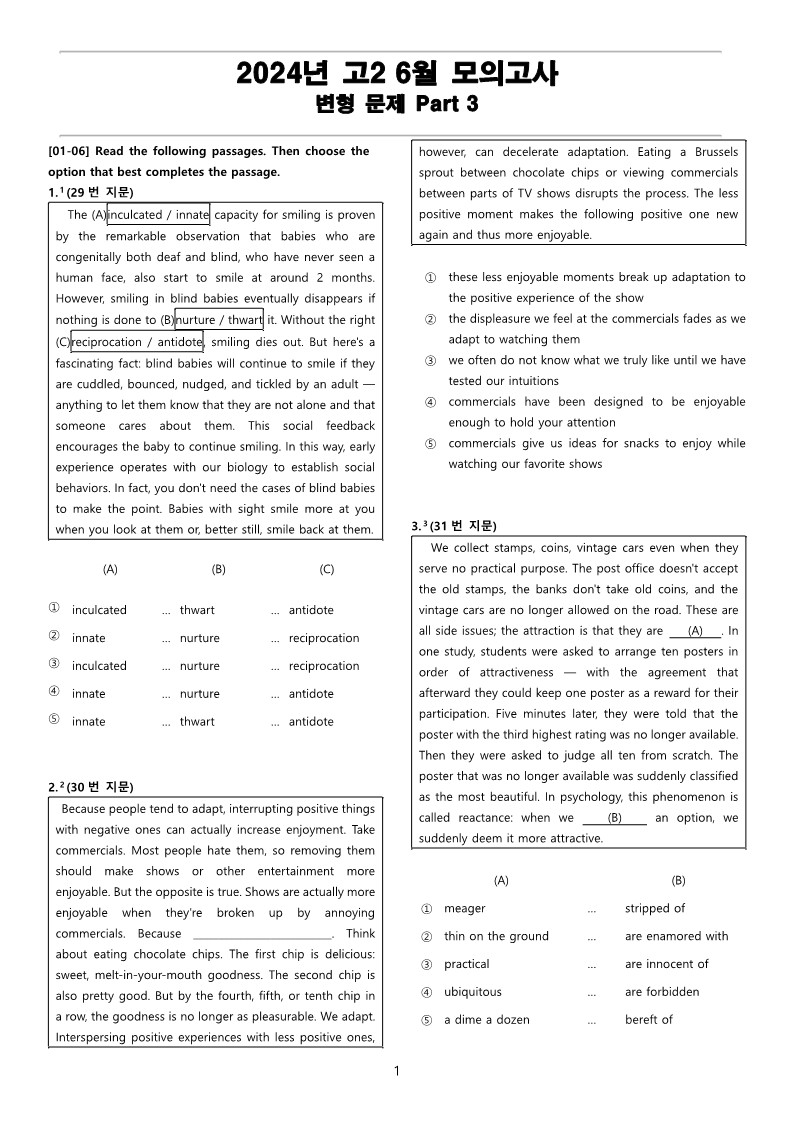

The Makings의 2024년 고2 6월 전국 연합 모의고사 변형 문제 Part 3 은

총 11개의 유형으로 구성되어 있습니다.

1. 빈칸 채우기(객관식)

2. 글의 내용 일치/불일치(객관식/한글 선택지)

3. 글의 내용 일치/불일치(객관식/영어 선택지)

4. 글 끼어 넣기(객관식)

5. 어법(서술형)

6. 어휘(서술형)

7. 주제문(객관식/영어 선택지)

8. 어휘 빈칸 채우기(서술형)

9. 영작(서술형)

10. 요약문 완성하기(서술형)

11. 문단 재배열 하기(객관식)

더메이킹스(The Makings)가 제작한

2024년 고2 6월 전국 연합 모의고사 변형 문제 Part 3의 지문입니다.

1번 지문(문항 번호 29번)

The built-in capacity for smiling is proven by the remarkable observation that babies who are congenitally both deaf and blind, who have never seen a human face, also start to smile at around 2 months. However, smiling in blind babies eventually disappears if nothing is done to reinforce it. Without the right feedback, smiling dies out. But here's a fascinating fact: blind babies will continue to smile if they are cuddled, bounced, nudged, and tickled by an adult ― anything to let them know that they are not alone and that someone cares about them. This social feedback encourages the baby to continue smiling. In this way, early experience operates with our biology to establish social behaviors. In fact, you don't need the cases of blind babies to make the point. Babies with sight smile more at you when you look at them or, better still, smile back at them.

2번 지문(문항 번호 30번)

Because people tend to adapt, interrupting positive things with negative ones can actually increase enjoyment. Take commercials. Most people hate them, so removing them should make shows or other entertainment more enjoyable. But the opposite is true. Shows are actually more enjoyable when they're broken up by annoying commercials. Because these less enjoyable moments break up adaptation to the positive experience of the show. Think about eating chocolate chips. The first chip is delicious: sweet, melt-in-your-mouth goodness. The second chip is also pretty good. But by the fourth, fifth, or tenth chip in a row, the goodness is no longer as pleasurable. We adapt. Interspersing positive experiences with less positive ones, however, can decelerate adaptation. Eating a Brussels sprout between chocolate chips or viewing commercials between parts of TV shows disrupts the process. The less positive moment makes the following positive one new again and thus more enjoyable.

3번 지문(문항 번호 31번)

We collect stamps, coins, vintage cars even when they serve no practical purpose. The post office doesn't accept the old stamps, the banks don't take old coins, and the vintage cars are no longer allowed on the road. These are all side issues; the attraction is that they are in short supply. In one study, students were asked to arrange ten posters in order of attractiveness ― with the agreement that afterward they could keep one poster as a reward for their participation. Five minutes later, they were told that the poster with the third highest rating was no longer available. Then they were asked to judge all ten from scratch. The poster that was no longer available was suddenly classified as the most beautiful. In psychology, this phenomenon is called reactance: when we are deprived of an option, we suddenly deem it more attractive.

4번 지문(문항 번호 32번)

If we've invested in something that hasn't repaid us ― be it money in a failing venture, or time in an unhappy relationship ― we find it very difficult to walk away. This is the sunk cost fallacy. Our instinct is to continue investing money or time as we hope that our investment will prove to be worthwhile in the end. Giving up would mean acknowledging that we've wasted something we can't get back, and that thought is so painful that we prefer to avoid it if we can. The problem, of course, is that if something really is a bad bet, then staying with it simply increases the amount we lose. Rather than walk away from a bad five-year relationship, for example, we turn it into a bad 10-year relationship; rather than accept that we've lost a thousand dollars, we lay down another thousand and lose that too. In the end, by delaying the pain of admitting our problem, we only add to it. Sometimes we just have to cut our losses.

5번 지문(문항 번호 33번)

On our little world, light travels, for all practical purposes, instantaneously. If a lightbulb is glowing, then of course it's physically where we see it, shining away. We reach out our hand and touch it: It's there all right, and unpleasantly hot. If the filament fails, then the light goes out. We don't see it in the same place, glowing, illuminating the room years after the bulb breaks and it's removed from its socket. The very notion seems nonsensical. But if we're far enough away, an entire sun can go out and we'll continue to see it shining brightly; we won't learn of its death, it may be, for ages to come ― in fact, for how long it takes light, which travels fast but not infinitely fast, to cross the intervening vastness. The immense distances to the stars and the galaxies mean that we see everything in space in the past.

6번 지문(문항 번호 34번)

Financial markets do more than take capital from the rich and lend it to everyone else. They enable each of us to smooth consumption over our lifetimes, which is a fancy way of saying that we don't have to spend income at the same time we earn it. Shakespeare may have admonished us to be neither borrowers nor lenders; the fact is that most of us will be both at some point. If we lived in an agrarian society, we would have to eat our crops reasonably soon after the harvest or find some way to store them. Financial markets are a more sophisticated way of managing the harvest. We can spend income now that we have not yet earned ― as by borrowing for college or a home ― or we can earn income now and spend it later, as by saving for retirement. The important point is that earning income has been divorced from spending it, allowing us much more flexibility in life.

'전국 연합 모의고사 변형 문제 > 고2 모의고사 변형 문제' 카테고리의 다른 글

| 2024년 고2 9월 전국 연합 모의고사 변형 문제 Part 1 (0) | 2024.09.13 |

|---|---|

| 2024년 고2 6월 전국 연합 모의고사 변형 문제 Part 4 (0) | 2024.06.18 |

| 2024년 고 2 6월 전국 연합 모의고사 변형 문제 Part 2 (0) | 2024.06.14 |

| 2024년 고 2 6월 전국 연합 모의고사 변형 문제 Part 1 (0) | 2024.06.12 |

| 2024년 고2 3월 전국 연합 모의고사 변형 문제 Part 4 (0) | 2024.04.09 |