2022년 고2 11월 전국 연합 모의고사

변형 문제 2

2022년 고2 11월 전국 연합 모의고사 변형 문제 2

출판사에서 오랫동안 영어 번역과 교정을 하셨던 원어민 선생님과

현직에서 강사를 하고 있는 연구진들이 학생들을 위한

최상의 2022년 고2 11월 전국 연합 모의고사 변형 문제 2 를 선보입니다.

사고력과 이해력을 요구하는 문제들로 내신 대비 뿐만이 아니라

수능도 한꺼번에 공부하실 수 있는 자료입니다.

중간고사&기말고사 전에 더메이킹스(The Makings)에서 제작한

2022년 고2 11월 전국 연합 모의고사 변형 문제로 마무리 하세요.

정답 확인 하러가기!

2022년 고2 11월 전국 연합 모의고사 변형 문제 2

2022년 고2 9월 전국 연합 모의고사 변형 문제, 내신대비, 영어내신자료,고등영어자료, 모의고사 변형문제,전국 연합모의고사 변형자료, 모의고사 영어 서술형 대비, 대치동 고등 영어자료, 대치

themakings.co.kr

themakings.co.kr

The Makings의 2022년 고2 11월 전국 연합 모의고사

변형 문제는 총 11개의 유형으로 구성되어 있습니다.

1. 빈칸 채우기(객관식)

2. 글의 내용 일치/불일치(객관식/한글 선택지)

3. 글의 내용 일치/불일치(객관식/영어 선택지)

4. 글 끼어 넣기(객관식)

5. 어법(서술형)

6. 어휘(서술형)

7. 주제문(객관식/영어 선택지)

8. 어휘 빈칸 채우기(서술형)

9. 영작(서술형)

10. 요약문 완성하기(서술형)

11. 문단 재배열 하기(객관식)

더메이킹스(The Makings)가 제작한 2022년 고2 11월 전국 연합 모의고사

변형 문제 2의 지문입니다.

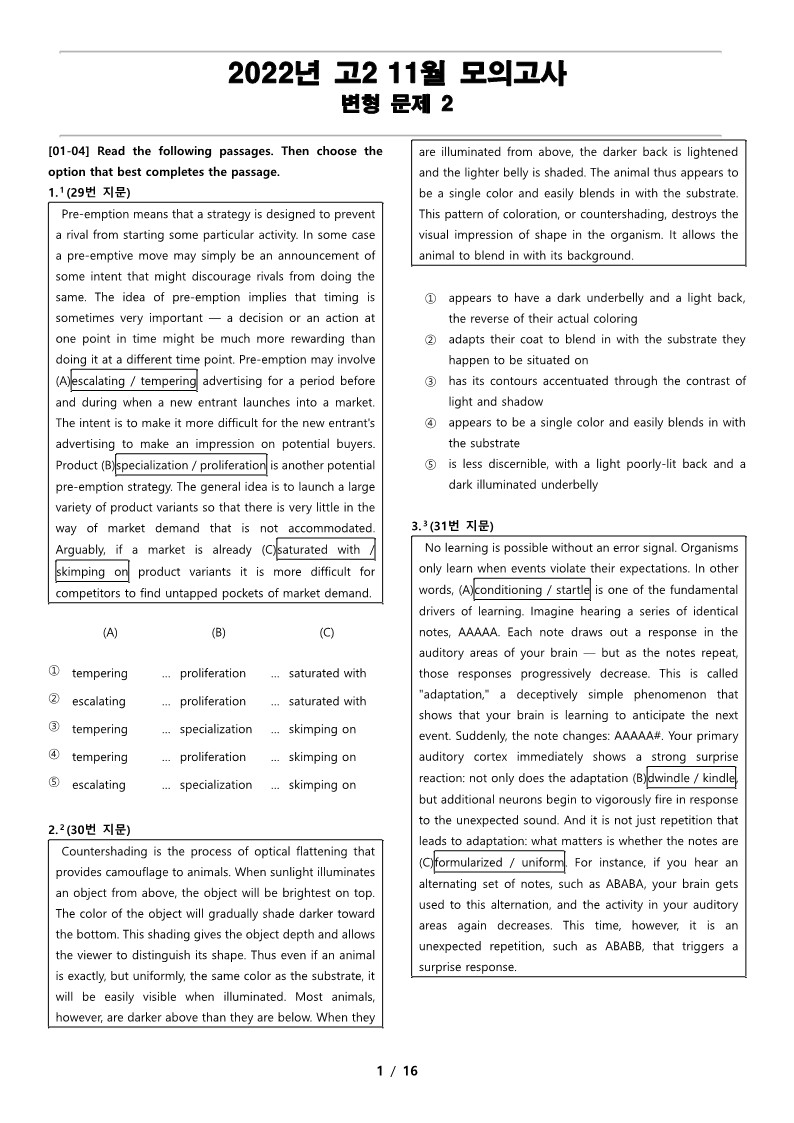

1번 지문(문항 번호 29번)

Pre-emption means that a strategy is designed to prevent a rival from starting some particular activity. In some case a pre-emptive move may simply be an announcement of some intent that might discourage rivals from doing the same. The idea of pre-emption implies that timing is sometimes very important ― a decision or an action at one point in time might be much more rewarding than doing it at a different time point. Pre-emption may involve up-weighting advertising for a period before and during when a new entrant launches into a market. The intent is to make it more difficult for the new entrant's advertising to make an impression on potential buyers. Product proliferation is another potential pre-emption strategy. The general idea is to launch a large variety of product variants so that there is very little in the way of market demand that is not accommodated. Arguably, if a market is already filled with product variants it is more difficult for competitors to find untapped pockets of market demand.

2번 지문(문항 번호 30번)

Countershading is the process of optical flattening that provides camouflage to animals. When sunlight illuminates an object from above, the object will be brightest on top. The color of the object will gradually shade darker toward the bottom. This shading gives the object depth and allows the viewer to distinguish its shape. Thus even if an animal is exactly, but uniformly, the same color as the substrate, it will be easily visible when illuminated. Most animals, however, are darker above than they are below. When they are illuminated from above, the darker back is lightened and the lighter belly is shaded. The animal thus appears to be a single color and easily blends in with the substrate. This pattern of coloration, or countershading, destroys the visual impression of shape in the organism. It allows the animal to blend in with its background.

3번 지문(문항 번호 31번)

No learning is possible without an error signal. Organisms only learn when events violate their expectations. In other words, surprise is one of the fundamental drivers of learning. Imagine hearing a series of identical notes, AAAAA. Each note draws out a response in the auditory areas of your brain ― but as the notes repeat, those responses progressively decrease. This is called "adaptation," a deceptively simple phenomenon that shows that your brain is learning to anticipate the next event. Suddenly, the note changes: AAAAA#. Your primary auditory cortex immediately shows a strong surprise reaction: not only does the adaptation fade away, but additional neurons begin to vigorously fire in response to the unexpected sound. And it is not just repetition that leads to adaptation: what matters is whether the notes are predictable. For instance, if you hear an alternating set of notes, such as ABABA, your brain gets used to this alternation, and the activity in your auditory areas again decreases. This time, however, it is an unexpected repetition, such as ABABB, that triggers a surprise response.

4번 지문(문항 번호 32번)

The connectedness of the global economic market makes it vulnerable to potential "infection." A financial failure can make its way from borrowers to banks to insurers, spreading like a flu. However, there are unexpected characteristics when it comes to such infection in the market. Infection can occur even without any contact. A bank might become insolvent even without having any of its investments fail. Fear and uncertainty can be damaging to financial markets, just as cascading failures due to bad investments. If we all woke up tomorrow and believed that Bank X would be insolvent, then it would become insolvent. In fact, it would be enough for us to fear that others believed that Bank X was going to fail, or just to fear our collective fear! We might all even know that Bank X was well-managed with healthy investments, but if we expected others to pull their money out, then we would fear being the last to pull our money out. Financial distress can be self-fulfilling and is a particularly troublesome aspect of financial markets.

'전국 연합 모의고사 변형 문제 > 고2 모의고사 변형 문제' 카테고리의 다른 글

| 2022년 고2 11월 전국 연합 모의고사 변형 문제 4 (0) | 2022.12.05 |

|---|---|

| 2022년 고2 11월 전국 연합 모의고사 변형 문제 3 (0) | 2022.12.04 |

| 2022년 고2 11월 전국 연합 모의고사 변형 문제 1 (0) | 2022.12.01 |

| 2022년 고 2 6월 전국 연합 모의고사 변형 문제 4 (0) | 2022.10.12 |

| 2022년 고 2 6월 전국 연합 모의고사 변형 문제 3 (0) | 2022.10.09 |